Australian banks

Let’s talk about Australian banks shall we? Or more precisely, the most basic service a bank can offer: safe storage of, and easy access to your money.

Now from my experience in the UK it’s a given that you can walk into any high-street bank, and they’ll have a bank account that offers the above for free. In addition, you’ll almost certainly be given a cash card so you can use any ‘Link’ ATM in the UK with no additional charges. There’s also a pretty good chance that you’ll be offered some kind of EFT card: a Visa debit card perhaps. This card will be filled with technology in order to secure your transactions, while providing maximum possible convenience.

Things aren’t like that in Australia. If you can find a bank which will give you a day-to-day bank account with no monthly charges, then you’re off to a very good start. I have found one, and I was assured I would receive a debit card as part of the deal. Unfortunately, a debit card here isn’t the same as a debit card anywhere else. Here, a debit card is actually a cash card: you can use it at ATMs, and over-the-counter, but that’s it. What I really wanted was a Visa debit card.

Actually, what I should have asked for was a Visa debit card. What I wanted isn’t readily available here: a card which is chip-and-pin enabled. This is somewhat confusing, as every single store in Sydney that I’ve been into has a chip-and-pin terminal. Why would a bank, issuing a new account holder a new card, not give them a card with a chip in it? Surely that would be future-proofing the whole setup? And wouldn’t everyone be better off and more secure what with the chip-and-pin infrastructure already being in place?

As things stand, I have to pay an additional fee for that. Until then, I won’t be able to use my card if I visit the UK without an argument with most shops there.

Part 2 of this story: ATMs. This is what happens when I ask to withdraw money using either my debit card or my Visa debit card at an ATM provided by my own bank:

Image lost

Read ‘em and weep. Eight options, when only one of them actually works. The rest result in an error message and the return of your debit/Visa debit card. I would like to think this frustrates most people, but as someone who spends his life making technology as easy to use and understand for users as possible, this is shocking. If only one option works, why offer the other seven?

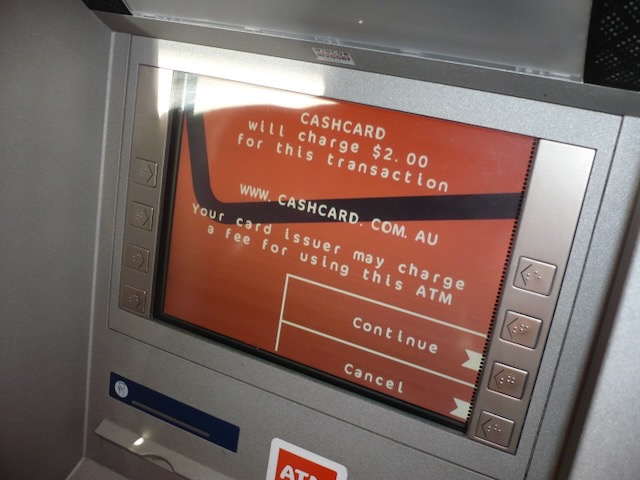

And to drill home the thing about everything here having the “additional fees” tag, here’s another snapshot. In the UK we’re used to being able to use any ATM for free, with the exception of some machines which are in convenience stores and the like. Here, if you use any ATM which isn’t provided by your own bank, you will be charged. This picture was taken when I attempted to find out my balance from a ‘foreign’ ATM:

$2 just to check my balance.

Update Friday 21st May 21 2010

I bought an e-book the other day, which was provided by a US company. Turns out I get charged for that kind of behaviour as well.

Help me out here kids: is it just my UK building society that doesn’t do this kind of crazy thing?